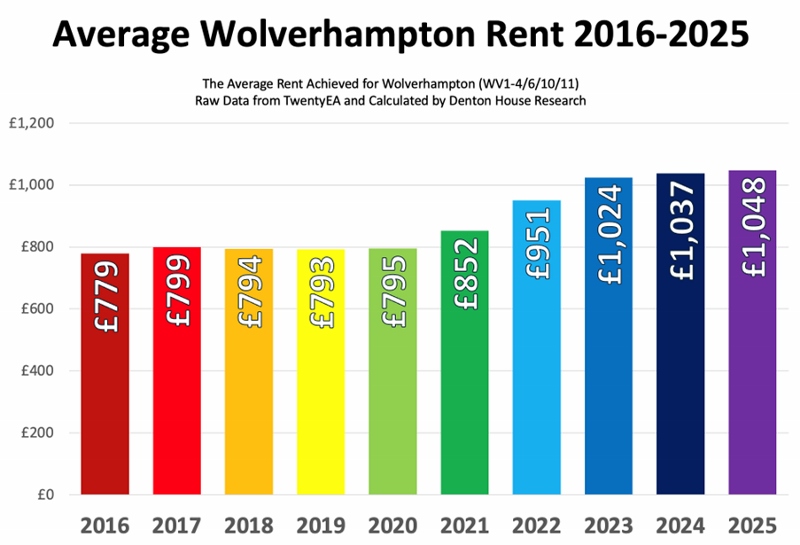

Wolverhampton rents have risen 34.5% or £269 per calendar month (pcm)

from £779 pcm in 2016 to £1,048 pcm in 2025

That is a significant shift in just under a decade.

Yet, things get even more interesting when we break down that growth each year. The growth in Wolverhampton rents (WV1-4/6/10/11) isn’t linear.

- 2016 - £779 pcm

- 2017 - £799 pcm

- 2018 - £794 pcm

- 2019 - £793 pcm

- 2020 - £795 pcm

- 2021 - £852 pcm

- 2022 - £951 pcm

- 2023 - £1,024 pcm

- 2024 - £1,037 pcm

- 2025 - £1,048 pcm

Now, note we mentioned inflation in the article. Since 2016, inflation in the UK has been 35.2%. This means Wolverhampton rents have risen 0.7% less than the rate of inflation.

If Wolverhampton rents had risen by inflation, they would be £1,053 pcm,

instead of £1,048 pcm

So, what does this all mean for Wolverhampton tenants and Wolverhampton landlords?

For Wolverhampton renters, this growth in rents may have meant adjusting expectations, moving to more affordable areas, or simply having less disposable income at the end of the month. With the high cost of living, rent rises can understandably be viewed with frustration or worry.

It's also worth recognising that a significant proportion of those in the rental market fall into the lower quartile income demographic, with many (not all) tenants working in roles that pay just the minimum wage. Encouragingly, the National Minimum Wage has substantially increased over the past decade—from £6.70 an hour in 2016 to £12.21 in 2025, an 82.1% uplift. For many renters, this uplift in wages has played a vital role in helping to offset their rising housing costs, particularly for those in the lower quartile of the income distribution. While challenges around affordability remain, this wage growth has undoubtedly improved the financial resilience of many working households—especially those most likely to rent.

For Wolverhampton landlords, what’s often missing from this conversation on rent is the increasing pressure landlords have been under during the same period. The cost of maintaining properties has climbed significantly with the cost of materials and labour costs. From energy performance requirements and licensing rules to Section 24 tax changes and interest rate rises, many Wolverhampton landlords are facing slimmer margins—or, in some cases, losses. Rent, in this context, is not just a fee; it's a reflection of market forces and a necessity to make the provision of private housing viable.

Why This Matters for Wolverhampton Tenants and Landlords Alike

So, what do we do with all this data?

With Wolverhampton landlords, it’s about helping you understand tenants' economic pressures while reinforcing the need for fair, sustainable returns on your buy-to-let investments.

With Wolverhampton tenants, it's about providing transparency and reassurance—showing that Wolverhampton rent levels haven't skyrocketed in isolation but in line with broader financial trends.

Crucially, for policymakers and housing campaigners, this kind of local data points to the need for localised solutions. There is no ‘one-size-fits-all’ answer to rental affordability. What works in Bradford may not apply in Maidstone, and what's true for a landlord in Truro might be utterly different in Glasgow.

Looking Ahead: What Could Influence Wolverhampton Rents Next?

The key driver behind rent increases is wages. When minimum wages rise faster than inflation, it naturally expands affordability for tenants—which in turn allows for rents to grow at a similar or slightly higher pace. However, it’s important to strike the right balance. According to data from Denton House Research, around one in five rental properties that came onto the market in the last 12 months have had their asking rent reduced. This suggests there's room to start slightly higher, but if you're not attracting interest, it's crucial to realign your pricing with the actual market rate. Doing so helps avoid prolonged void periods and ensures you secure a tenant without unnecessary delay.

With the Bank of England expected to adjust interest rates over the coming year, landlords' mortgage costs could fall—or rise further, depending on economic conditions. Meanwhile, local councils are under pressure to improve standards and protect tenants from poor practices while encouraging more homes to be made available for rent.

In this uncertain landscape, the best route forward is transparency, empathy, and data-driven conversations.

By recognising the dual pressures on Wolverhampton tenants and landlords—and arming ourselves with insight rather than outrage—we can help shape a Wolverhampton rental market that works fairly for everyone.