Blog

- Details

When most homeowners decide to put their Wolverhampton home on the market, they assume one thing.

The chances their home will sell are very good.

After all, why wouldn’t it? You ask an estate agent to place your home on the market, the board goes up, pictures of your home appear on the portals and viewings subsequently get booked and offers made.

Except it is not. Looking at every Wolverhampton estate agent…

Over the last two years, the chances of selling your

Wolverhampton home and moving have been 66.8%

The remaining 33.2% of homes failed to sell, withdrawing from the market unsold.

(Wolverhampton WV1-4/6/10/11).

And those chances vary immensely, property to property.

Whether you end up selling your home or not practically always comes down to two things.

- The marketing of your home.

- The pricing of your home.

We have spoken many times recently in previous blog posts about marketing, so for this article we wish to focus on pricing strategy. Every Wolverhampton home is unique. Its layout, type, condition, price band, location, presentation and even timing all go together to make a difference. Let us share with you what we found about the Wolverhampton property market and the chances of getting your home sold (and moved), split down by price band and type.

So, we have looked at the data for every Wolverhampton property that has left every Wolverhampton estate agent’s book over the last two years. Then calculated how many have successfully sold (and exchanged and completed) versus how many were withdrawn and never sold.

The results are eye opening.

The Wolverhampton Selling Odds by Price Bracket

- Up to £250k: 3,039 Wolverhampton homes sold & moved, 1,224 unsold & withdrawn. 71.3% success rate.

- £250k to £500k: 1,761 Wolverhampton homes sold & moved, 1,029 unsold & withdrawn. 63.1% success rate.

- £500k to £1m: 239 Wolverhampton homes sold & moved, 220 unsold & withdrawn. 52.1% success rate.

- £1m+: 17 Wolverhampton homes sold & moved, 28 unsold & withdrawn. 37.8% success rate.

So, as asking prices increase, the odds of selling your home fall.

The Wolverhampton Selling Odds by Type

- Bungalows: 63.1% success rate.

- Houses: 68.1% success rate.

- Apartments/flats: 64.3% success rate.

- Others (character property/building plots/mobile homes/retirement homes): 36.7% success rate.

Why Do Higher-Priced Wolverhampton Homes Find It Harder to Sell?

As property values rise, the number of potential buyers naturally reduces. The market becomes thinner at the top end. There are fewer proceedable purchasers, affordability pressures intensify and mortgage lending criteria become more demanding. Even financially comfortable buyers tend to exercise greater caution when borrowing costs are elevated.

Beyond simple affordability, higher value homes are often more complex to price accurately. Comparable evidence is usually more limited, and properties differ more widely in specification, layout and location. This makes precise positioning more difficult and increases the risk of misjudging the market.

There is also a behavioural factor. Some agents understandably value the visibility that prestige homes bring to their portfolio. However, the desire to secure an impressive instruction can sometimes lead to optimistic pricing. At higher price points, even a relatively small degree of overvaluation can significantly reduce early interest. In many cases, overpricing becomes the most significant obstacle to securing a sale.

The Risks Attached to Overpricing

During the unusually buoyant conditions of 2021, many sellers were able to achieve ambitious asking prices. Demand outstripped supply, borrowing was inexpensive and buyers were competing strongly.

Those conditions no longer apply.

In today’s Wolverhampton market, pricing above the level buyers perceive as fair is one of the most reliable ways to see a property withdraw unsold. Once initial momentum is lost, subsequent reductions often struggle to recreate urgency. Buyers may question why the home has not already sold, and confidence can quietly diminish. The data suggests that this pattern is particularly evident in certain higher price brackets.

The Role of the Estate Agent

A common misconception among Wolverhampton sellers is that asking price equates to value. In reality the value is defined not by what you, your neighbour or best friend thinks it’s worth, but only by what a committed ready, willing and able buyer is prepared to pay.

Attracting that buyer requires more than online portal exposure. In current market conditions, three factors are especially important.

First, setting a price that aligns with comparable evidence and buyer expectations from the outset. Second, carefully qualifying prospective purchasers to ensure they are financially and procedurally ready. Third, managing negotiations firmly and guiding the transaction all the way through to exchange and completion.

Experienced Wolverhampton agents recognise that buyer psychology plays a central role. They balance optimism with realism, maintain communication throughout the process and aim to create competitive tension where possible rather than relying solely on passive interest.

Interpreting the Saleability Statistics on the Wolverhampton Market

Every Wolverhampton property is individual. Location, presentation, condition and timing all influence outcomes. The figures discussed reflect broad trends rather than predictions for any specific home.

Some Wolverhampton properties will outperform the averages. Others may struggle despite strong presentation. The critical point is not simply to be aware of the statistics, but to understand how they relate to your own circumstances and price bracket.

A More Useful Question for Wolverhampton Sellers

Instead of asking, “What price would I like to achieve?”, Wolverhampton homeowners might consider a more practical question: “What pricing strategy gives me the strongest chance of completing my move?”

Very few people put their home on the market with the intention of testing it indefinitely. The objective is to exchange contracts, complete and get you moved on to the next stage.

Pricing remains the single most significant variable within a seller’s control. The decision made at launch can either build momentum or quietly restrict it.

It is also important to remember that the financial outcome of moving is determined not solely by the sale price achieved, but by the relationship between that figure and the cost of the onward purchase. The true cost of moving lies in the gap between the two transactions, not in the headline price alone.

That broader perspective is often overlooked when decisions are made at the outset of a sale.

- Details

In this detailed market update, we explore:

• Current average house prices in Walsall

• How the market has performed over the past 12 months

• Property values by type

• The local rental landscape

• What buyers and sellers should expect in 2026

All figures referenced are based on the latest available data from the UK House Price Index (HM Land Registry/ONS) and the ONS Private Rental Index.

Walsall House Prices in 2026: Where Are We Now?

According to the most recent UK House Price Index data, the average property price in Walsall stood at approximately £215,000–£220,000 at the close of 2025, reflecting annual growth in the region of 4–5% year-on-year.

This follows a period of adjustment during 2023, when higher mortgage rates cooled activity across the UK. Throughout 2024 and into 2025, however, we saw improved stability as borrowing conditions became more predictable and buyer confidence gradually returned.

How Does Walsall Compare?

• The average house price across England remains significantly higher (well above £290,000).

• Walsall therefore continues to offer strong relative affordability within the West Midlands.

• Local growth has been steady rather than volatile — a positive indicator of sustainable demand rather than short-term speculation.

For homeowners, this means equity has continued to build at a sensible pace. For buyers, Walsall remains one of the more accessible areas within reach of Birmingham and the wider Black Country.

Property Prices by Type in Walsall

Breaking the data down by property type provides useful context:

• Detached homes: Typically averaging in the region of £340,000–£360,000

• Semi-detached properties: Commonly around £210,000–£230,000

• Terraced houses: Frequently between £170,000–£190,000

• Flats and apartments: Often in the £110,000–£140,000 range

(These figures reflect UK House Price Index averages and market sales data across the past 12 months.)

What This Tells Us

Three-bedroom semi-detached homes continue to represent one of the strongest-performing segments of the local market, driven by family demand. Entry-level terraces and apartments remain attractive to first-time buyers, while detached properties command a premium in established residential areas.

Overall, demand remains consistent across core property types, with pricing sensitivity more noticeable in the higher-value brackets.

⸻

Time on Market & Buyer Behaviour

Over the past year, the average time to secure a buyer locally has generally ranged between 10 and 14 weeks, depending on pricing strategy, presentation and location.

We are seeing:

• Well-priced homes generating strong early interest

• Over-ambitious listings requiring later price adjustments

• Buyers taking slightly longer to commit compared to the highly competitive 2021 market

In short, Walsall is operating in a “normalised” market — neither overheated nor subdued.

For sellers, correct pricing at launch is now more important than ever.

The Walsall Rental Market in 2026

The private rental sector in Walsall has shown continued growth.

ONS data indicates that average private rents locally are now around £875–£900 per calendar month, reflecting annual growth of approximately 6%.

What’s Driving Rental Growth?

• Continued tenant demand

• Limited supply of quality rental homes

• Landlords factoring in higher finance and compliance costs

For investors, this has supported gross rental yields that often sit between 5% and 7%, depending on purchase price and location.

For tenants, affordability remains an important consideration, particularly in the context of wider cost-of-living pressures.

What’s Influencing the Walsall Property Market?

Several key factors continue to shape local conditions:

1. Mortgage Rate Stability

Following volatility during 2022–23, mortgage rates have stabilised considerably. While they are no longer at historic lows, the predictability of borrowing costs has helped restore confidence among buyers.

2. Relative Affordability

Compared with Birmingham and many southern regions, Walsall offers:

• Lower entry prices

• Strong value per square foot

• Competitive yields for landlords

Affordability continues to underpin steady demand.

3. Local Appeal & Connectivity

Walsall’s transport links, access to major motorway networks, schooling options and ongoing regeneration projects all support continued housing need.

Markets built on practical demand — rather than speculation — tend to demonstrate greater long-term resilience.

Is 2026 a Good Time to Buy in Walsall?

For buyers who are financially prepared, 2026 presents a period of relative stability:

• Price growth remains modest rather than sharp

• Mortgage products are more predictable

• Stock levels are healthier than during the supply shortages of 2021–22

This gives buyers room to negotiate while still recognising that quality homes attract competition.

Is It a Good Time to Sell?

For sellers, success depends heavily on strategy.

Homes that are:

• Accurately valued

• Well presented

• Professionally marketed

…are continuing to achieve solid outcomes.

Overpricing, however, can lead to extended marketing periods and eventual reductions. In today’s environment, realism delivers results.

⸻

Investment Outlook for Landlords

Walsall remains attractive to property investors because of:

• Competitive purchase prices

• Consistent tenant demand

• Healthy rental yields

However, landlords must remain mindful of:

• Ongoing regulatory changes

• EPC requirements

• Tenant rights reforms

Professional lettings management is increasingly important in protecting compliance and long-term returns.

Outlook for the Remainder of 2026

Most national forecasts point towards:

• Modest single-digit house price growth

• Continued, though potentially moderating, rental inflation

• A broadly balanced market between buyers and sellers

For Walsall specifically, the outlook appears steady rather than dramatic. There are no strong indicators of significant decline, but equally, rapid price surges are unlikely. The fundamentals — affordability, demand and regional connectivity — remain supportive.

Why Local Expertise Matters

Property markets are highly localised. Two streets within the same postcode can perform very differently depending on presentation, pricing strategy and buyer demand.

National headlines rarely reflect what is happening on the ground in Walsall. That is why tailored advice based on live market activity and transactional evidence is so important.

Thinking of Moving in Walsall?

Whether you are:

• A first-time buyer

• A growing family needing more space

• A landlord reviewing your portfolio

• Or a homeowner considering selling

Understanding current market conditions gives you confidence and clarity.

At Skitts, we combine up-to-date data with genuine local insight across Walsall and surrounding areas. If you would like a confidential, no-obligation market appraisal or simply a conversation about your options, our team would be delighted to help.

Final Thoughts

The Walsall property market in 2026 is defined by balance.

It is growing — but sustainably.

Active — but not overheated.

Affordable — yet increasingly competitive in key segments.

For those making informed decisions, it remains a market full of opportunity.

- Details

The property market is frequently misunderstood, especially amid dramatic news stories. Here’s what Wolverhampton homeowners need to know to avoid costly traps.

To understand the property market, it is important to consider the broader context.

Nationally, house price growth is treading water at 2.5% a year, and there were 663k UK homes available for sale in the month of January, compared to the three-year pre-COVID average level of 559k. That said, homes are still selling. In fact, 6.8% more West Midlands properties were sold in January 2026 compared to January 2024.

Looking at Wolverhampton, 230 homes sold stc in January 2024, whilst in January 2026 that had risen to 242, a 5.22% increase.

In January 2024, Wolverhampton had 1,332 homes for sale: by January 2026, 1,373.

And that is precisely why pricing strategy matters now more than ever if you want to sell.

Why Pricing Right in Wolverhampton is Important

Launching your Wolverhampton home at an overly ambitious price will damage your chances of selling and the price you achieve.

Buyers search within set budgets. If your property sits above comparable homes, it is filtered out before it is even seen. Even when it does attract attention, an inflated price can suggest you are testing the market rather than being serious about selling.

The result is often a slow start, followed by price reductions. The longer a home sits unsold, the more buyers begin to wonder what is wrong with it. That doubt can linger, even if the only issue was the initial price.

A realistic, market-aligned asking price attracts more interest, builds momentum, and increases the likelihood of a successful sale and completion. Here are four key statistics that illustrate these points:

- Nationally, in 2025, only 55.4% of homes were sold and moved (the other 44.6% remained unsold). In simple terms, you only had just over a one in two chance of moving if you put your home up for sale last year.

- Another fact is that if a property has not secured a buyer by week twelve, its chance of selling is just 14.5%.

- Next stat, when a home agrees a sale within the first 25 days (typically because it is priced realistically), it has a 94% chance of reaching exchange and completion (i.e., you move). Leave it until day 100, and should you agree a sale on your home (which will be low anyway), that success rate to get you from sale agreed to exchange and completion drops to 56%. Speed is not luck. It is usually pricing.

- Finally, for homes that receive a buyer and reach a sale agreement, those with no price reductions are 135% more likely to complete the sale than those with reductions. Additionally, they typically sell in about a third of the time and have only half the risk of falling through compared to reduced-price properties. Pricing correctly at launch preserves your equity and significantly increases your odds of successfully moving.

Focus on Wolverhampton

Let us look at the extent of the problem in Wolverhampton.

In 2025, 3,793 Wolverhampton homes left the books of all the estate agents in Wolverhampton.

When a property leaves the books of an estate agent, only one of two things can happen. Either the property is sold (i.e., it exchanges and completes), meaning the homeowner moves, or, secondly, the property is withdrawn from the market unsold, leaving the homeowner stuck.

Of those 3,793 Wolverhampton homes, 2,575 moved home (i.e., exchanged and completed).

And 1,218 withdrew unsold.

So, in 2025, only 67.89% of Wolverhampton homes listed for sale resulted in successful moves for their owners. The remaining 32.11% were withdrawn unsold.

(Wolverhampton = WV1/2/3/4/6/10/11).

Some might say, well of course, the property could leave that estate agent’s books and go to another agent in the city. Will it surprise you that only 6.9% of all UK home sales sell with the second estate agent? It takes a particular set of skills to sell a property that has been on the market before. (Feel free to contact us to find out what is needed the second time round).

Independent research from Which backs this up, showing that homes priced sensibly from day one sell faster and, in many cases, achieve a stronger final outcome than those launched 5% to 10%+ too high and then reduced. Buyers are well informed. If a property looks overpriced compared to similar Wolverhampton homes, they simply move on.

The Costly Trap of Overvaluing. What it Means for Your Wolverhampton Move

If you want to sell in Wolverhampton, the smartest place to start is with a realistic asking price.

Overvaluing/over pricing might feel reassuring at first. It can sound ambitious. It can even feel flattering. But once your home hits the market, you only get one true launch window. Those first few weeks are when buyer attention is at its strongest. Miss that moment with an inflated price, and momentum quickly fades. What should have been excitement becomes hesitation.

Across Wolverhampton, more homes are coming to market priced above what buyers see as value.

Too often, this is driven by certain estate agency chains that are chasing instructions rather than completions. The result is predictable. A property sits. Interest cools. The price is reduced. Valuable time is lost. As we have already discussed, the longer it takes to secure a buyer, the lower the likelihood that the sale will reach exchange and completion. For many homeowners, that delay means losing the ‘forever home’ they had hoped for.

Compounding the issue, those same estate agency models that focus heavily on winning instructions also tie homeowners into long sole agency agreements. That length of contract often gives the agent time to talk the seller down from an inflated launch price rather than getting the pricing right at the outset. The problem, as explained earlier, is that the longer a property sits on the market, the lower the probability of it selling and, if it does secure a buyer, the lower the likelihood of that sale reaching exchange and completion.

On top of that, to add salt to the wound, some estate agency structures reward their staff for listings secured rather than sales completed. In a stabilising market like Wolverhampton’s, that approach is risky because it incentivises listing your home rather than selling it.

Correct pricing is not about being conservative. It is about being competitive.

Outlook for the Wolverhampton Property Market

We are unlikely to see dramatic house price spikes in the immediate future, but nor is there evidence of a major correction ahead. The national picture is more stable than many headlines suggest.

Longer-term drivers remain supportive. Demographic shifts, flexible working as well as a resilient labour market all underpin housing demand. UK interest rates are widely expected to sustain a gradual downward trend throughout 2026, with most forecasts placing the Bank of England base rate in the range of 3% to 3.5% by the end of 2026, assuming inflationary forces remain manageable. This would gradually improve affordability and buyer confidence. At the same time, wage growth has been running above inflation over the past year, quietly strengthening household balance sheets.

The market is definitely not without its pressures. Affordability remains sensitive to mortgage pricing, and broader economic policy will continue to play a role. Yet the fundamentals suggest a more balanced environment rather than a distressed one.

For Wolverhampton homeowners, the message is simple. In a market with more choice and greater buyer scrutiny, pricing realistically from the outset puts you in control. It protects your position, strengthens your negotiating power and gives you the best chance of moving on your terms.

If you are considering a move in Wolverhampton, a clear, data-led market appraisal can help you understand where your property truly sits in today’s market and how to place it for a successful sale. Feel free to contact us for a no-obligation talk about anything in this or our other articles on the Wolverhampton property market.

- Details

Many Wolverhampton rental problems do not start with bad landlords or difficult tenants.

In Wolverhampton, as in many cities across the country, they usually start with good intentions and silence. Silence about rent reviews. Silence about maintenance. Silence about what happens when life changes.

Let me give you a scenario we see more often than people realise.

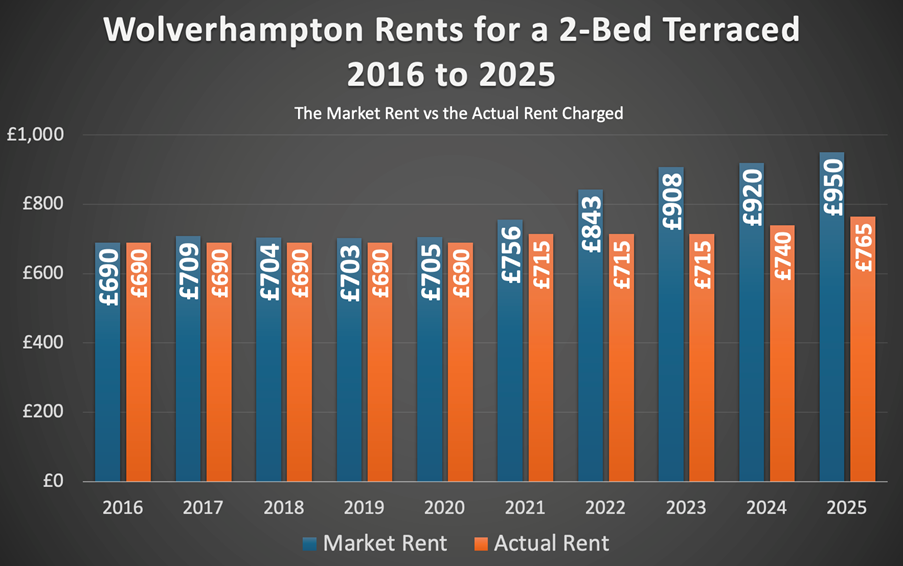

It’s a story of a tenant who moved into a two-bedroom terraced house in Wolverhampton in 2016. At the time, the rent was a very fair £690 per calendar month. It reflected the market, the condition of the home, and the local demand. Both landlord and tenant felt comfortable with the arrangement and the relationship was positive from day one.

By 2020, the monthly rent was still at £690, yet the market rate had risen to £705 (not much of a gap). Two years later (2022), the landlord had increased the rent to £715, yet the market rent was now at £843. In 2025, the rent was now £765, yet the market rent was £950, meaning there was a difference of £185 per month between the rent being paid and the market rent.

From the Wolverhampton landlord’s perspective, this rarely feels like a mistake at the time. The tenant pays reliably. They look after the home. There are no voids, no advertising costs, no awkward conversations. Increasing the rent feels uncomfortable, especially when the tenant has been loyal. Many landlords convince themselves they are doing the right thing by leaving things as they are.

From the tenant’s side, stability is everything. They built their household budget around that rent. Children settle into local schools. The house becomes a home rather than just a rental. They may notice the kitchen is dated or the bathroom could do with attention, but the rent feels fair for what they are getting, so they do not push too hard.

This is where the slow drift begins.

Rents in Wolverhampton since 2016 had risen by 37.7%, yet the landlord had only increased them by 10.9% ...

… and because the rent no longer reflected the market, the property often stops receiving the level of investment it should. Small maintenance jobs get postponed. Bigger improvements are quietly shelved. Neither party feels quite justified in demanding more, because the arrangement has become unspoken and informal. The low rent becomes part of the compromise.

Then something changes.

The landlord’s circumstances change. It might be retirement, a change in job, a separation, or simply the need to release capital. The decision is made to sell. On paper, the property should be worth a certain figure. Though, with a sitting tenant paying £185 per month below market rent, the property will have a suppressed yield and, because the property needs cosmetic work, will not achieve the same price as one producing full market rent.

The Wolverhampton landlord now faces options they never planned for.

One option is to push the rent up sharply on their Wolverhampton home to improve the figures to improve the value of the buy-to-let home. Another option is to remove the tenant to sell vacant. Yet most landlords hesitate, hoping the problem will resolve itself. Eventually, pressure wins and the property goes onto the market at a discounted price (with a sitting tenant) and sells for less than it should have done.

At this point, the tenant believes they are out of the woods, yet nothing could be further from the truth.

The new landlord owner doesn’t have the emotional connection with that tenant, so brings the rent up themselves to a market level. When the rental increase lands, the jump can be by many hundreds of pounds a month. For a tenant who has shaped their life around the previous rent, this can be unmanageable and shocking.

What follows is rarely smooth. Negotiations fail. Notices are served. Stress levels rise. In the worst cases, it ends with legal action and forced moves. Nobody feels good about it, yet everyone feels trapped by decisions made years earlier by the first landlord.

The uncomfortable truth for both Wolverhampton landlords and tenants is that regular, modest rent reviews are usually the kindest option over time for everyone. Gradual increases allow tenants to adapt. Fair market rents allow Wolverhampton landlords to maintain properties properly. Most importantly, they reduce the likelihood of sudden sales that trigger upheaval for everyone involved.

This is not about squeezing tenants or defending bad practice. It is about recognising that pretending the market does not exist does not protect people, it just delays the consequences. Slow, predictable change is far easier to live with than sudden shocks.

Sometimes, what looks like fairness in the moment quietly plants the seeds of a crisis years down the line.

If you are a ‘kind’ Wolverhampton landlord and manage the home yourself, and what we have said rings an alarm bell for you then, if you would like some free advice and our opinion, let’s have an informal chat. Call us on 0121 520 2255 and speak to the lettings team.

- Details

In early 2023, property forecasters predicted a significant UK housing downturn over the next two years, citing rising interest rates following Liz Truss's departure. Halifax expected an 8% drop, Savills predicted a 10% drop, and Nomura Bank forecast up to a 15% drop.

While these gloomy forecasts successfully grabbed headlines and generated clicks, the actual market data three years later tells a completely different story.

According to the Land Registry, the reality has been far more resilient. UK house prices are 3.93% higher today than they were in January 2023. Locally, the picture is also one of stability rather than collapse, with Wolverhampton house prices being 7.29% higher than in January 2023.

Yet even with those statistics, now that we are starting 2026, we are again hearing the same nervous question being asked all over again. Newspaper reports on the run-up to Christmas 2025 stated that there were months when house prices were dropping and asking … with these drops, will 2026 be the year house prices correction?

Putting the Property Market Data in Context

Before we start, let us all agree that bad news sells newspapers.

So, looking at the data, the first thing to note is that over the last three years, house prices in Wolverhampton have experienced many ups and downs in the Wolverhampton Land Registry averages.

For example, in February 2024, annual house prices in Wolverhampton were falling at 2.6% per annum, yet by March 2025, they were rising at 8.3% per annum. The latest Land Registry stats show we are 6.9% higher than a year ago locally.

The point here is not to look at one month in isolation, but to examine the broader trend over the medium term, because statistics without context can be misleading.

The Leading Indicator That Predicts Growth

For a deeper look at what is actually happening, we can turn to Denton House Research. They uniquely track the £/sq.ft figures at the "sale agreed" date in the UK. This is a vital metric because the £/sq.ft figures track the Land Registry data five months in advance with a 98% correlation. We have done the calculation using the £/sq ft over the last 3 years. If you recall, we stated above that UK house prices had risen by 3.93% over the last 3 years; the £/sq.ft figures showed a 3.59% rise using the same method.

This means we effectively know what will happen to the published Land Registry house prices five months in advance with a very high level of certainty.

Five months ago, the average price per square foot for UK home sales was £341.85, and today it stands at £346.02. Therefore, based on this calculation, UK house prices should be 1.22% higher by July than they are today. None of these points leads to a crash. Quite the opposite, they point to a resilient underlying value.

Next, let us look at other metrics that signpost towards stability.

Confidence Returning to the UK and Wolverhampton Property Markets

When we look specifically at the total number of property sales in the Wolverhampton area, the narrative of a crash falls apart even further. For example, in the last six months of 2022 (July to December), 1,268 Wolverhampton homes were sold subject to contract. In the same period in 2025, that figure was 1,528. This increase is a clear sign of market confidence. Buyers are active, and deals are being done.

(Wolverhampton WV1/2/3/4/6/10/11).

Looking at this January’s data, the UK property market has hit the ground running in 2026. There is remarkable momentum across every key metric. 96,500 new UK homes have been listed year-to-date. This figure is already 0.5% ahead of 2025 and 17.5% up on 2024. It is also 34% higher than the pre-pandemic average. This increase in choice is being met with eager demand rather than oversupply. Gross sales are healthy at 62,700 UK homes sold subject to contract. That sits 23.5% higher than 2024 and 30.6% above pre-COVID norms. Net sales are accelerating with a strong week-on-week uplift. So far, we have seen 46,100 net sales, running 35% ahead of 2024 and 40% above the 2017–19 average. This signals a highly confident and active start to the year.

The Mortgage & Employment Landscape

Another key reason for the relative resilience of Wolverhampton house prices is the environment surrounding low mortgage rates. After climbing to over 6% in late 2022, rates have stabilised and are expected to continue to fall gradually through 2026. For example, a five-year (70% Loan-to-Value) fixed-rate mortgage is available at 3.72%, or a 5% deposit first-time buyer five-year fixed-rate mortgage at 4.53%. Further reductions are likely if the Bank of England continue to cut its base rate later in the year. This shift in affordability is expected to improve buyer sentiment and support price levels.

Also crucially, the UK labour market remains strong. Unemployment is low, currently sitting at around 5.1%, and wage growth is holding steady at 4.7% per year. Also, there is little sign of the kind of financial stress that forces mass sales or repossessions, which typically precede major house price crashes.

Why 2026 is Nothing Like 2008

Another critical factor that is often overlooked is the increasing regulation of mortgage lending over the past decade. Since the introduction of the Mortgage Market Review in 2014, borrowers have had to demonstrate that they can afford repayments at interest rates significantly higher than those they signed up to.

This stress testing was designed to create market resilience, and it has been incredibly effective. Even at the height of ultra-low rates of 2020/2021, when mortgages were typically between 1.5% and 2.5%, those new borrowers had to demonstrate that they could afford repayments of 6.5% or 7%. So now, even though rates have risen, most existing homeowners coming off those rates in 2026 are already equipped to manage the change. The reckless lending of the past is simply not present in today's market.

What About Those 20% House Price Drops in London?

Of course, there are significant variations across the UK.

Some small parts of Central London (Mayfair, Chelsea and Kensington etc.), which attracted foreign investment over the last 20 years, have experienced a significant drop in house prices over the last six months (some areas more than 20% in six months).

Over the last 20 years, these ‘posh’ London areas have seen huge explosion in their house prices, way over the London and national averages because of that investment. That increase didn’t affect the rest of the London or UK property market. Now we are seeing an equally significant drop in house prices in those areas, as many of those foreign property owners are divesting of their London property. So, when the papers report, as we're sure they will in the coming months, of house price drops in Central London, I hope you will remember this.

Could a House Price Correction Still Occur?

It is not impossible, but the necessary conditions are not present. To see a genuine correction, we would need a perfect storm. We would need a sharp rise in unemployment, a sudden spike in interest rates, a collapse in mortgage availability, and a wave of forced sales. We would need another global financial crash for that to happen.

The foundation of the UK housing market is far stronger than it was in 2008 or the late 1980s. There is no subprime mortgage crisis, no rampant overborrowing, and no glut of unsold new builds.

In conclusion, although the UK housing market in 2026 faces challenges, the data indicates a direction towards stability. A correction remains highly unlikely. Most regions are expected to experience slow but steady growth, with some pricier areas dipping slightly. Overall, the narrative for 2026 is one of cautious optimism.

Ignore sensational correction forecasts; rely on the data. For buyers or sellers in 2026, strong opportunities exist, especially for those who know their local market and keep a long-term perspective. This is a stable, normalising market, far from collapse.