Blog

- Details

A study of this year’s property market

and what will happen in 2026?

With only a few weeks to go before the end of the year, as a Wolverhampton estate and letting agent, we wanted to share what has happened in both the UK and Wolverhampton property markets in 2025, analysing the trends for Wolverhampton homeowners, home buyers and landlords alike… and then compare them to previous years.

All statistics for each year are up to 16 November (to ensure a level playing field). Starting with the UK statistics, looking at new properties on the market (listings), sales agreed and houses sold (i.e. exchanged and completed).

The Number of Homes Coming on the Market in the UK

In 2023, 1,407,751 homes were listed for sale across the UK. That number rose to 1,521,906 in 2024 and 1,567,258 in 2025.

The average asking price of homes coming to market in 2023 was £422,722, with an average of £361 per square foot. In 2024, this increased to £430,868 and £372 per square foot. By 2025, the average asking price remained steady at £429,684, while the average price per square foot increased again to £383.

This rise in £/sq.ft wasn’t driven by broad price growth, but by a shift in the type of homes being listed. More smaller, lower-priced homes (which usually achieve a higher £/sq.ft) and more high-end properties (which also tend to sit higher on that metric) came to market. With fewer mid-priced homes in the mix, this change lifted the overall £/sq.ft price, despite headline asking prices barely moving.

The Number of Homes Sold in the UK

In 2023, 824,665 homes across the UK went under offer (sold subject to contract) at an average price of £356,026, equating to £331 per square foot. By the end of that year, 689,542 of those deals reached exchange and completion, achieving an average final sale price of £357,134, or £330 per square foot.

Fast forward to 2024, and both activity and values edged up. A total of 958,239 homes sold subject to contract at an average of £360,755 (£338 per square foot), while 734,148 reached exchange and completion at £355,168 and £332 per square foot.

Then came 2025, when the market found another gear. 997,472 homes were agreed upon for sale at an average of £362,703 (£334 per square foot), and 782,776 reached exchange and completion at £361,086 and £338 per square foot.

What’s striking is that while average prices have barely shifted year to year, the £/sq.ft figures reveal the real story. It’s not that homes are getting more expensive, but that the mix of what’s selling is changing. More smaller properties and more high-end homes both push up the £/sq.ft figure, even as overall prices remain broadly level. It's a reminder that the shape of the market can change the numbers just as much as the prices themselves.

The number of transactions has risen sharply, yet the average price paid for a UK home remains the same, and the £/sq.ft figure has remained broadly stable. In other words, house prices haven't really climbed, but the volume of sales has surged. And that matters, because the most accurate indicator of the health of the UK property market isn't house prices at all, it's how many homes are selling.

Such a marked shift in both activity and market composition warrants a closer examination to understand what is driving it and what it might mean for local markets, such as Wolverhampton.

What’s Behind the UK Property Market’s Continued Stability?

Several key forces have fuelled the property market’s renewed momentum:

- Falling Mortgage Rates: As borrowing costs have eased, buyers who held off during the rate peaks of 2023 have started to return, restoring confidence and unlocking pent-up demand.

- Wage Growth: Steady, above inflation increases in earnings have strengthened affordability for many households, giving buyers greater confidence to take their next step.

- Low (but slightly rising) Unemployment: Although unemployment increased slightly in 2025, it remains close to historic lows. The job market remains strong enough to provide people with the security needed to commit to major purchases, such as a home.

- Evolving Lifestyles: Post-pandemic shifts in how and where people want to live continue to shape demand. Many buyers are still prioritising space, flexibility, and quality of life over simple location.

- Not Enough Homes Being Built: A growing and ageing population has collided with decades of under-delivery. The UK needs around 300,000 new homes every year to keep up with demand; yet, over the past 30 years, it has averaged only around 210,000 per year. That shortfall of roughly 2.7 million homes has created intense pressure on both prices and availability, leaving supply far behind where it needs to be.

Combined, these trends have helped sustain activity and sentiment in the housing market, even as wider economic conditions remain mixed.

Wolverhampton’s Property Market: A Comparative Analysis of 2023 vs 2024 vs 2025

In 2023, a total of 3,327 homes were listed for sale in Wolverhampton, with an average asking price of £256,664. That same year, 1,894 properties were successfully exchanged and completed, achieving an average sale price of £237,813.

In 2024, listings edged higher as 3,385 homes came onto the market, with the average asking price of £269,082. The number of exchange/completions also increased at 2,048 homes, with the average price achieved remaining similar at £241,185, indicating that well-priced homes continued to attract solid buyer demand.

By 2025, Wolverhampton’s market found another gear. 3,480 homes were listed for sale at an average asking price of £278,176. 2,127 homes went on to exchange and complete, up 3.8% on the previous year, at an average sale price of £258,528.

What stands out is the steady rise in the number of homes being brought to market and the growth in completed transactions, even as achieved prices have held relatively stable. Sellers have become increasingly confident about listing their homes for sale, while buyers remain active, creating a healthier and more balanced property market in Wolverhampton.

In short, Wolverhampton’s property market has seen consistent progress since 2023. More homes are being listed, more sales are getting over the line, and the gap between asking and achieved prices remains realistic. It’s a sign of a market that’s maturing rather than overheating… steady, grounded, and underpinned by genuine demand rather than speculation.

(Wolverhampton is WV1/2/3/4/6/10/11).

What About the 2026 Property Market?

Wolverhampton's property market does not operate in isolation. It is shaped by a mix of local influences that often mirror national trends yet play out differently here. Employment levels, new infrastructure projects, and demographic shifts all affect local demand and supply for homes. Regional policies also play a part, influencing everything from development opportunities to rental dynamics. For homeowners and landlords alike, understanding these local nuances is crucial for making informed, well timed decisions.

As we move into 2026, the UK property market continues to show stability, but (and it’s a big but) Wolverhampton won't follow the national picture exactly. Local variations will always matter more than national averages, and that is where real opportunity lies. Local market knowledge remains a significant advantage for Wolverhampton homeowners looking to sell or landlords managing their portfolios. Knowing where your property sits within the Wolverhampton market can help you spot opportunities and avoid pitfalls.

In the last two years, only half (53%) of the homes in the UK that came on the market actually sold, whilst in Wolverhampton, it has

been 63.72%.

That alone underlines the single most important rule in the Wolverhampton property market: price your home realistically from day one. Every house has a price window where it attracts maximum interest. Start too high, and you miss those crucial first few weeks when the most motivated buyers are active.

Additionally, among UK homes that do sell, 53% sell within 35 days and 71% within 63 days. Selling quicker also increases your chance of getting to exchange and completion (i.e. you moving home). Denton House Research, after analysing over 2 million UK home sales, found that properties that see a buyer within 25 days of the home coming on the market have a 94% chance of reaching completion. Yet if the sale is agreed after 100 days of the home coming on the market, the chance of it completing falls to 56%.

Further evidence from Hamptons supports this. Analysing millions of home sales since 2001, they found that (excluding the Covid years) British homes typically sell within 0.9% to 1.3% of their final asking price. That’s the price before going under offer, not the original asking price if it was later reduced. This highlights the importance of setting the right price from the outset.

As an experienced local estate agent in Wolverhampton, I understand the patterns behind these numbers. My goal is to help you set a realistic asking price that maximises your sale potential while achieving a strong market value. I study Wolverhampton’s housing data daily, tracking what sells, what doesn’t, and why, so your home is priced to sell, not to sit. If you are planning to move in 2026 and want a professional, data led approach that works with the realities of today’s Wolverhampton market, get in touch. Together, we will position your property to attract the right buyers quickly and secure a smooth, successful sale.

- Details

Some homes in Wolverhampton fly off the market within weeks. Others sit for months, attract only a handful of viewings, then quietly disappear from the portals, unsold.

The difference isn’t luck, it’s sellability.

Would it surprise you that of the 10.94 million homes that have left UK estate agents books since January 2019, only 6.33 million (or 57.86%) sold and moved. The other 4.61 million came off the market unsold. This is the extent of the sellability issue.

Looking more locally, the past two years of data reveal a clear pattern in Wolverhampton’s market. Some types of homes are far more likely to sell than others. Let’s look at what the numbers show and what that means for homeowners and landlords across the city.

Sellability by Wolverhampton Property Type

Let’s start with property type (comparing it to the national figures):

In the past two years, 67.25% of houses in Wolverhampton that left all estate agents books in the city sold and completed (i.e. the home owner moved), compared with 61.04% nationally.

64.86% of Wolverhampton flats and apartments sold, while nationally it was 45.98%.

Whilst 62.14% of bungalows sold in Wolverhampton, compared with 57.35% nationally.

Sellability by Wolverhampton House Price Range

Price, of course, changes everything. So, looking at the last two years:

At the lower end, Wolverhampton homes priced up to £250,000 sold 71.24% of the time, compared to the 63.16% national figure.

Between £250,000 and £500,000, 60.88% of Wolverhampton homes sold (and completed) versus 54.25% nationally.

53.48% of £500,000 to £750,000 priced Wolverhampton homes found buyers and sold, compared with 45.77% nationally.

£750,000 to £1 million, the sellability of Wolverhampton homes drops to 51.4%, while nationally it’s 42.47%.

And finally, in the £1 million-plus bracket, just 38.46% of listings in Wolverhampton resulted in a completed sale, compared with 34.78% across the UK.

It shows that the higher the price, the lower the sellability rate because the number of buyers able or willing to pay top end prices in Wolverhampton is limited.

Why Some Wolverhampton Homes Sell and Others Don’t

The numbers tell us what happened, but not why. The reasons usually fall into three camps.

- Price positioning.

Every home has a price window where it attracts maximum interest. Start too high and you miss the crucial first few weeks when buyers are most active.

Denton House Research found after analysing over 2 million house sales, that properties finding a buyer within 25 days have a 94% chance of the sale completing (i.e. you moving). After 100 days, even if the home does sell (which is slim), the chance of your sale getting to completion (and you moving home) drops to 56%.

Roughly half of all homes that come to market ever find a buyer. But for the ones that do, speed matters. 41.8% sell within the first 28 days, 70.9% within 63 days, and by 100 days, 77.7% have agreed a sale.

Starting with a realistic price is further backed up with data from Hamptons that shows of the millions of homes that have sold since 2001, aside from the Covid year, British homes have typically sold within about 0.9% to 1.3% of their ‘final’ asking price (final as in the headline asking price before it went sale agreed – not the original asking price if it was reduced in price after it came on the market). This again shows how vital it is to price realistically from the start.

- Marketing quality.

Buyers buy with their eyes. Listings with poor photography and weak descriptions get scrolled past. Presentation can be the difference between a viewing and a swipe. - Agent skill and communication.

The best Wolverhampton estate agents keep momentum. They update, negotiate, and manage buyers and solicitors through the sticky middle of a transaction. Others simply upload to portals and wait. The difference shows up in these sellability figures.

What It Means for Wolverhampton Homeowners Planning 2026 Moves

The Wolverhampton market is not broken, but it is selective. The data shows that most homes priced sensibly will sell. It’s the ones that start too high or stand still that struggle.

In estate agency, sellability isn’t luck. It’s about strategy, the right price, the right preparation, and the right partner guiding the process.

If you’re thinking of moving in 2026 and want an evidence-based view of how sellable your Wolverhampton home really is, ask for the facts before you list. The numbers rarely lie, and knowing them could be the difference between a For Sale board and a Sold sign.

- Details

If you have ever thought about selling your Wolverhampton home, you will know how tempting it can be to stretch the asking price. After all, it is your biggest tax-free asset, and those extra few thousand pounds can feel like a sensible cushion. Yet in the Wolverhampton property market, ambition can sometimes cost more than it earns.

Over the past five and a half years, 6,665 Wolverhampton homeowners have come away from the market without selling. Many of them started with high hopes, only to find their homes withdrawn months later, unsold and unloved by buyers who had moved on to better-priced options.

The Data Behind the Frustration

To understand how this has unfolded, let us look at what has actually happened across Wolverhampton (WV1-4, WV6, WV10 and WV11) since 2020.

Before we start, a property sale is only legally binding when the home's exchange and completion is finalised. Only then can the homeowner move. Therefore, we will only look at that.

- Of the 3,602 Wolverhampton properties that left estate agents’ books in 2020, 2% exchanged and completed. The other 34.8% of homeowners, a total of 1,253 homes, withdrew from the market unsold.

- Of the 3,885 Wolverhampton properties that left estate agents’ books in 2021, 9% exchanged and completed. The other 28.1% of homeowners, a total of 1,093 homes, withdrew from the market unsold.

- Of the 3,384 Wolverhampton properties that left estate agents’ books in 2022, 9% exchanged and completed. The other 27.1% of homeowners, a total of 917 homes, withdrew from the market unsold.

- Of the 3,501 Wolverhampton properties that left estate agents’ books in 2023, 4% exchanged and completed. The other 37.6% of homeowners, a total of 1,316 homes, withdrew from the market unsold.

- Of the 3,678 Wolverhampton properties that left estate agents’ books in 2024, 4% exchanged and completed. The other 35.6% of homeowners, a total of 1,310 homes, withdrew from the market unsold.

- Of the 2,417 Wolverhampton properties that left estate agents’ books in 2025 (so far), 9% exchanged and completed. The other 32.1% of homeowners, a total of 776 homes, withdrew from the market unsold.

So, over the last five and a half years, 6,665 Wolverhampton homeowners, who had spent months and months marketing their homes, only finished back where they started.

The main reason? Overvaluing.

Why Overvaluing Happens

When an estate agent visits your home, the valuation conversation can feel like a performance. You might hear one agent suggest £285,000, another £300,000, and then someone confidently says £325,000 without hesitation. It is flattering. It is exciting. It is often a trap.

Some Wolverhampton agents know precisely what number will win the instruction. They do not need to sell the home straight away; they only need to list it. In many cases, sellers are tied into long agency contracts, during which the price is quietly reduced until it reaches reality.

By that time, the most motivated buyers have already dismissed it.

The Consequences of an Inflated Asking Price on Your Wolverhampton Home

An overpriced property sits on the market longer than it should. Buyers start to ask questions. Why has it not sold? Is there something wrong with it? When a home lingers unsold, it develops a stigma. Even after the price is reduced, newer listings look fresher and attract more interest.

Independent data from Denton House Research and TwentyEA clearly shows the impact.

41.8% of UK homes that do go under offer (i.e., sale agreed/sold stc) do so within 28 days, and 70.9% of sales agreed, do so within 63 days.

And even if you do take longer to sell, the chances of actually moving drop like a stone. You see, UK homes that go under offer within 25 days of coming to the market have a 94% chance of subsequently exchanging and completing (i.e., you moving). Homes that take over 100 days to find a buyer subsequently see their success rate of getting to exchange and completion (i.e., move) drop to just 56%.

So, not only does overvaluing waste months, it also slashes the odds of your moving.

The Wolverhampton Property Market Has Changed

During late 2020 and all of 2021, the Wolverhampton market was fuelled by record demand, cheap borrowing, and pandemic relocation. Agents could list almost anything, and it would sell. That period created unrealistic expectations that still linger today.

However, since the middle of 2022, things have normalised. The average time on market has lengthened, price reductions have risen sharply, and buyers have regained negotiation power. The average property now sells for around 98.6% of its final asking price, compared with nearly 102% during the boom. That shift may not sound dramatic, but on a £500,000 home, it is almost £17,000 less in the seller’s pocket.

Overvaluing only widens that gap and reduces the chance your home will sell (and you move home).

Why Wolverhampton Estate Agents Keep Doing It

If overvaluing hurts homeowners and agents alike, why does it continue?

Pressure. Some larger estate agency firms still judge performance by listings, not completions. Staff bonuses are often linked to how many homes they put on the market, not how many they sell. As a result, the motivation shifts from accuracy to acquisition.

Telling a Wolverhampton seller what they want to hear wins more listings than telling them the truth. It also allows agents to appear “busy” in their marketing updates, even when most of their listings remain unsold.

It is a volume game, and the homeowner pays the price.

The Emotional Toll for Wolverhampton Homeowners

For many, overvaluing does more than delay a sale. It destroys plans. Wolverhampton families who wanted to upsize, Wolverhampton retirees looking to downsize, and couples moving for work have all been stuck in limbo. The months spent waiting, re-photographing, reducing, and re-listing add emotional fatigue on top of financial frustration.

By the time an offer finally appears (if it ever does), many homeowners are exhausted and willing to accept less to move on. Ironically, that often means they sell for less than they would have achieved if the home had been priced right from the beginning.

How to Avoid the Trap as a Wolverhampton homeowner

- Seek multiple opinions.

Invite at least two or three Wolverhampton agents to value your home. If one figure stands out as much higher, ask for evidence. Question: What percentage of their listings actually reach completion? Be very careful about tying yourself to a long sole agency agreement.

- Research sold data, not asking prices.

Use portals to check homes marked as "Sold Subject to Contract" or "Sold". These reflect what buyers are really paying, not what sellers hope for.

- Track the local ratio of listings to sales.

If more than 40% of homes on the portals are sold STC, it is a seller's market. If that figure falls below 30%, buyers have the upper hand.

- Work with an agent who values trust over flattery.

A good agent focuses on the end goal: your exchange and completion, not just a board outside your home. Confidence should come from competence, not contracts.

The Truth About Overvaluing

Overvaluing feels harmless at first. It sounds optimistic, even clever, bonus money in your back pocket. Yet in practice, it costs homeowners time, money, momentum, and, actually, you moving.

The data does not lie. Since January 2020, 13,802 Wolverhampton homeowners have sold and moved, yet 6,665 Wolverhampton homeowners have withdrawn from the market without selling, most due to unrealistic pricing. These are not failed homes. These are frustrated people.

If you are planning to sell, do not chase a fantasy number. Price your Wolverhampton home where the market is, not where you wish it were.

Remember, you only get one chance to make a first impression when your home hits the market. A realistic price attracts serious buyers quickly and gives you the best shot at moving successfully.

If you are thinking about selling and want an honest, evidence-based opinion on your Wolverhampton home's actual market value, with no fluff, no bull, no pressure, and no nonsense, we would be delighted to help.

- Details

Becoming a landlord can be a rewarding way to generate regular income and build long-term wealth through property. Alongside the rental returns, property values typically rise over time, creating strong potential for capital growth.

However, letting a property is not simply about collecting rent — there are many costs to consider. Being fully aware of these ensures you invest wisely, avoid surprises, and protect your profits.

Upfront Costs of Buying a Rental Property

If you’re purchasing a buy-to-let rather than using a property you already own, the initial outlay can be significant:

- Deposit – Buy-to-let mortgages usually can 25%–40%.

- Stamp Duty Land Tax (SDLT) – In addition to standard SDLT, a 5% surcharge now applies to second homes and buy-to-lets (from April 2025).

- Legal & Survey Fees – Conveyancing typically costs £1,000–£2,500, with surveys ranging from £250–£1,000.

- Mortgage Fees – Some lenders charge arrangement or valuation fees.

Financing Costs

Some landlords opt for interest-only mortgages, keeping monthly payments lower. Broker fees may also apply if you use an intermediary.

Ongoing Running Costs

Successful landlords budget for the day-to-day expenses of property ownership:

- Insurance – Buildings insurance is essential, but landlord policies provide wider cover such as rent protection and liability (typically £200–£800 annually).

- Ground Rent & Service Charges – Applicable on leasehold properties.

- Maintenance & Repairs – A good rule of thumb is to set aside 1% of the property’s value annually for general repairs, boiler servicing, replacements, and emergency call-outs.

Compliance & Legal Responsibilities

Landlords must meet strict safety and legal obligations, including:

- Gas Safety Certificate (annually, typically £60–£100).

- Electrical Installation Condition Report (EICR) (every 5 years, typically £150–£350).

- Energy Performance Certificate (EPC) (valid for 10 years, £100–£120, minimum rating E — due to rise to C).

- Fire Safety – Smoke and carbon monoxide alarms (typically £50–£100 each).

- Licensing – Some areas require landlord licences (£200–£1,000).

Letting & Management

If you appoint an agent, expect to pay:

- Tenant Find Service – Typically 100% of the first month’s rent.

- Full Management – Typically 10%–15% of monthly rent.

If self-managing, you’ll still face costs for referencing, inventories, and check-ins.

Void Periods & Turnover

Budget for periods without tenants — you’ll cover council tax, utilities, and re-letting costs. Between tenancies, refreshing the property with cleaning, repairs, or redecorating is often necessary.

Tax & Accounting

- Income Tax – Rental profits are taxed at your personal rate.

- Capital Gains Tax (CGT) – Payable when selling, at 18% for basic-rate taxpayers or 24% for higher-rate bands.

- Accountancy Fees – Professional tax advice can be worthwhile.

Hidden & Unexpected Costs

Even with careful planning, landlords should prepare for:

- Rent arrears or legal fees for evictions.

- Damage beyond deposit cover.

- Insurance excesses.

- Future regulation changes (e.g. the upcoming Renters’ Rights Bill).

Final Thoughts

Becoming a landlord in Walsall or Wolverhampton can be a profitable long-term investment, but it requires planning, compliance, and financial discipline. By understanding the true costs involved, you can make informed decisions and maximise your returns.

If you’re considering a buy-to-let or would like expert property management support, our lettings team at Skitts is here to help. Call us on 0121 520 2255 or email us at This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

It’s Tough, But Not as Tough as You Think

The typical first-time buyer home in Wolverhampton costs £175,170, which is a lot of money in anyone's book.

For years, the housing affordability debate has been framed in terms of house prices compared to average incomes. That makes a neat headline, but it isn't how first-time buyers think. When you are weighing up your first home in Wolverhampton, the question isn't "how many times my salary is the house worth?”. It’s “what slice of our take-home pay will the mortgage swallow each month?”

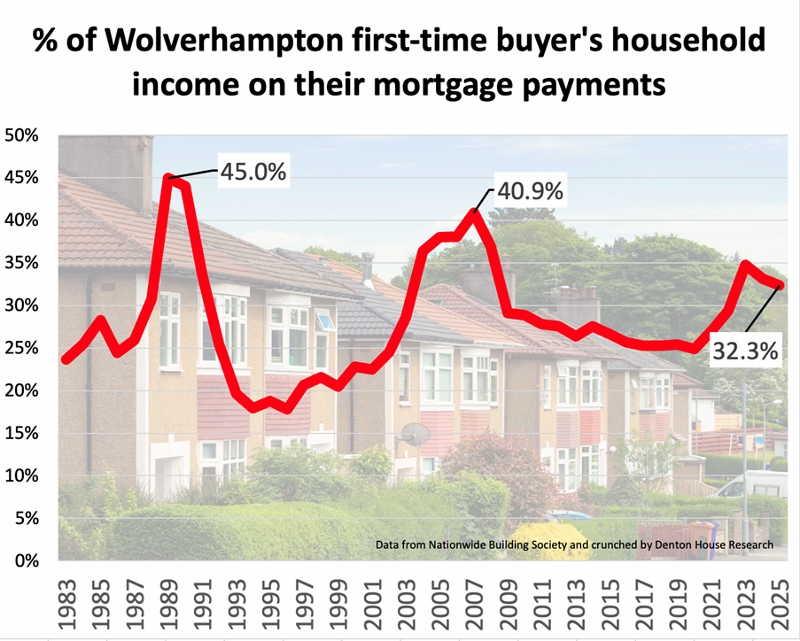

Looked at through that lens, the story for Wolverhampton first-time buyers is very different from the doom and gloom you often read. Yes, it is tough today, as mortgage payments take 32.3% of a Wolverhampton first-time buyer’s household income.

Yet, history shows there were periods when it was far tougher.

The late 1980s squeeze

Cast your mind back to the late 1980s. House prices were much lower in pound note terms, but interest rates were a punishing 14.4%. In 1989, first-time buyers in Wolverhampton were handing over 45.0% of their household income to cover mortgage payments (the national average was 47.2%). It was brutal.

The point is simple, Wolverhampton house prices were much lower at £43,190 in 1989, but the mortgage burden was far higher. Affordability, in the truest sense, was worse than today.

2007: déjà vu for new Wolverhampton first-time buyers

Fast-forward to the eve of the financial crisis. In 2007, first-time buyers in Wolverhampton had to commit 40.9% of their household income to their mortgage. Sound familiar? Another peak, another squeeze (the national average was 44.2%).

That number matters because it indicates that even in relatively recent history, affordability was worse than it is now. Today's first-time buyers often tell the older generation that “it was easier in your day." The numbers tell a completely different story.

The 2023 peak

Now, let's talk about the recent pain. In 2023, the affordability rate in Wolverhampton reached 34.8% of the household income. That was the highest in over 15 years. Mortgage costs soared on the back of rising interest rates, and many first-time buyers put their plans on ice (the national average was 37.4%).

Yet, and this is crucial, even at the 2023 peak, it was still 14.8% proportionally cheaper than in 2007, and 22.6% more affordable than the late 1980s.

A glimmer of relief for Wolverhampton first-time buyers

Since 2023, the burden for Wolverhampton first-time buyers has started to ease. In 2024, the rate dropped to 33.2%, and by 2025, it had decreased to 32.3%. Still heavy, still demanding discipline, but trending in the right direction.

This shift tells us two things. First, the market is not static as the environment for first-time buyers moves year to year. Second, affordability must be measured not just in pounds on a price tag but as a living, breathing percentage of real household income.

The role of wages and inflation

The average UK home today is £34,000 cheaper than it was in 2022, once adjusted for inflation.

At first glance, that sounds impossible. Let us explain.

The average value of a UK home in 2022 was around £270,000.

However, in the last three years there has been inflation of 11.45%. Therefore, a British home that cost £270,000 in 2022 would need to be worth £304,400 in today’s money to stand still regarding inflation (to have the same spending power). The average UK house price today is £270,400 (just £400 more – or 0.15% more). That gap means the "real" value of a home has dropped by 11.3% - (i.e. 11.45% inflation less 0.15% house price growth makes 11.3%).

Put another way, UK homes are effectively 11.3% or £34,000 cheaper.

At the same time, UK headline wages are 16.28% higher since 2022. Take inflation off that wage rise (16.28% wage growth less 11.45% inflation) and real ‘after inflation’ wages are 4.83% higher since 2022. So while headline house prices in headline (nominal) terms have flatlined, buyers’ actual spending power has strengthened.

That combination is rare. Properties are 11.3% cheaper in real terms, and incomes are 4.83% higher in real terms. Add to that the fact that interest rates, while still not at the levels seen in the 2010s (and they never will be again), rates are beginning to edge down, and more homes are coming onto the market, and the balance has shifted. Buyers now have more choice, and crucially, more negotiating power.

This wider backdrop matters. Inflation has taken a significant bite out of family budgets, but unlike the late 1980s, wages have also been rising. That is why the proportion of income going on mortgage payments hasn't rocketed back to the eyewatering levels we saw a generation ago.

Why the headline asking price of homes distracts us

A Wolverhampton starter home today looks eyewatering when you compare it with salaries. But the raw multiple of income to house price is a misleading way to judge affordability. What matters is whether the monthly mortgage outgoings are sustainable.

This perspective also explains why so many buyers do eventually take the plunge. A £200,000 headline asking price with a £190,000 mortgage may seem daunting, but a monthly payment of £995, once wages are factored in, can feel more achievable.

Peaks and troughs in perspective

History shows the journey is cyclical. There are peaks, there are troughs, and affordability is always more nuanced than the headlines suggest.

Final thought

Buying your first home in Wolverhampton will never be "easy." It takes saving, sacrifice, and the courage to make a commitment. But don't fall for the myth that it is uniquely impossible today. Previous generations faced even harsher affordability barriers, yet they still managed to climb the ladder.

Does this surprise you? Whether you are a parent advising your grown-up children or a first-time buyer yourself, the choice ultimately rests with you. Do you buy now, or wait?