Blog

- Details

Waiting is even riskier.

We all know the feeling. When you think about buying a home, you check the headlines, look at interest rates, and then tell yourself, "Maybe we’ll wait until things calm down.”

Waiting feels safe. You stay in control, you avoid risk, and you carry on as you are. However, when it comes to property, waiting is rarely a safe option. In fact, it can be one of the most expensive decisions you will ever make.

Every month you delay is a month of rent that will be gone forever. Every year you hesitate is a year of potential equity missed. The market doesn't stand still while you decide. It keeps moving.

The truth is simple: time in the market always beats timing the market.

History’s Harsh but Clear Lesson

People often convince themselves that the present moment is uniquely uncertain, but history shows that every era has looked scary in real time. Buyers then had the same doubts you do today. Yet the ones who stepped forward are the ones who came out ahead.

Take 1979. Mortgage rates shot up to 17%. Newspapers ran headlines about economic chaos and the winter of discontent. Imagine being a young Wolverhampton couple then, signing up for a mortgage with those eye-watering repayments. Many were told they were mad. Yet roll forward a decade, and those same buyers had seen their homes double in value while inflation steadily eroded the real burden of their mortgage.

Then came 1992, the year of Black Wednesday. The pound crashed, and the government hiked interest rates to 15% in a desperate defence. But again, those who owned property saw the long arc bend in their favour. What initially appeared terrifying in the short term ultimately became another stepping stone to financial security.

Or take autumn of 2007, the peak before the house price crash in 2008. If you bought that autumn, you almost certainly saw the value of your Wolverhampton home fall between 16% to 19% in the 18 months that followed. It felt brutal at the time. But what happened next? The market recovered, wages caught up, mortgages were paid down, and those who stayed the course ended up ahead again.

And of course, 2020 and 2021. The pandemic years. People wondered whether the housing market would even function. Some said house prices would collapse. Instead, activity surged, demand soared, and values rose strongly. Those who bought then are now sitting on equity, while those who waited are still paying rent and still wondering when the ‘perfect time’ will arrive.

At every ‘wrong’ moment, the same lesson repeats. Buying felt scary. Waiting felt safe. But buying won.

Why Waiting to Move Home Hurts Twice

Waiting doesn’t just mean “holding back.” It actively costs you money.

Here’s why.

There are only two places your monthly housing money can go: rent or mortgage.

When you rent, every pound vanishes the moment it leaves your account. Nothing builds. Nothing compounds. When you own, part of your monthly payment chips away at your loan. Month by month, your debt shrinks and your stake in the property grows.

And rents don’t stand still either. Over the last five years, rents have risen faster than wages in many areas. That means the longer you rent, the heavier the load becomes. It is like running on a treadmill that speeds up while you are on it.

By contrast, a fixed mortgage payment stays put. At first, it feels like a stretch. However, over time, as your salary increases and inflation erodes the value of money, the repayment becomes lighter.

So, waiting hurts in two ways. You pay more rent while waiting, and you lose out on years of equity growth that you could have been accumulating.

The Psychology of Hesitation

Why do so many people wait?

Partly it’s the fear of making a mistake. Buying a Wolverhampton home feels final, a big bet you don’t want to get wrong. So, you delay, convincing yourself that patience is a form of wisdom.

But there is another force at play: recency bias. We assume today's conditions will last forever. If rates are high, they will stay high. If house prices appear to be overvalued, they will likely crash. Yet history shows the opposite. Conditions always change. What looks certain today looks laughable with hindsight.

The truth is, there will always be a reason not to buy. Rates are too high. Prices are too high. Economy too shaky. Political risk. The reasons change, but the script is the same. And it keeps people stuck.

The Wolverhampton Stats

This is where numbers cut through the noise.

Looking at Wolverhampton as an example.

- A typical first-time buyer home in Wolverhampton cost £127,013 in July 2020 (Land Registry).

- Back then, with a 5% deposit of £6,351 on a 30-year 95% loan-to-value (LTV) mortgage, the monthly repayment on a five-year fixed mortgage would have been £15 at 2.79%.

Over five years, the 2020 buyer would have:

- Paid down about £13,852 of their mortgage.

- Seen their Wolverhampton home increase in value to £175,170.

- Built an equity in their property of £62,009.

- Remortgaged in June 2025 with a 30% deposit (because of the increase in equity), so LTV mortgage of 70% at 3.73%, meaning their monthly payments are £547.98 per month.

Over the same period, the renter would have:

- Paid out £51,840 in rent, rising from £665 pcm in 2020 to £1,063 pcm in 2025.

- Built nothing in return.

That’s the real cost of waiting. Not just higher house prices today, but five years of lost repayments, lost equity, and lost momentum.

The Hidden Emotional Costs of Waiting to Move Home

Money is only half the story. Waiting takes a toll on your quality of life as well.

- Decision fatigue. Every few months you check the market, talk yourself out of buying, and go back to scrolling Rightmove. The cycle repeats, draining your energy.

- Lifestyle drag. Renters often hold back from decorating, putting down roots, or making long-term plans because they don’t feel settled. Buying gives you stability to live fully in your space.

- Lost confidence. Each year of waiting makes the jump feel harder, not easier. The gap between what you could have done and what you now need to do only widens.

These are hidden costs, but they are every bit as real as pounds and pence.

Your Wolverhampton Home Moving Worries Answered

“What if Wolverhampton house prices fall after I buy?” They might. Markets move in cycles. But if you buy a home you can afford and plan to stay for five to ten years, history shows you come out ahead. Short-term dips are temporary. Long-term ownership compounds.

“What if interest rates rise again?” They could. But today’s rates are not extreme. Fix your mortgage, budget sensibly, and you are protected. Inflation will work in your favour over time.

“I’ll wait for the bottom.” The bottom only exists in hindsight. Nobody rings a bell when it happens. You do not need the bottom to do well. You just need to start.

Final Thoughts of Buying in Wolverhampton

Buying a home in Wolverhampton is never about picking the perfect moment. It is about starting the clock.

Every Wolverhampton buyer in the history of home buying has felt doubt. Those who acted moved forward. Those who waited fell behind.

So, if you are financially ready, the smartest step is not to keep waiting for perfection. It is to buy a good Wolverhampton home at a fair price and let time do the work.

Because your future self will not thank you for the years you spent renting, scrolling, and waiting for conditions that never came. They will thank you for getting started.

So, stop waiting. Start owning.

- Details

The Numbers Every Wolverhampton Homeowner Must See

If you’re a Wolverhampton homeowner or landlord thinking about selling in the next couple of years, the question on your mind is simple. How long will it take to find a buyer?

New data on the 828 Wolverhampton homes sold in the last 3 months has revealed some striking differences depending on the type of property and the number of bedrooms. On average, it takes 47 days to find a buyer. But dig deeper, and the picture changes:

By Wolverhampton property type:

- 101 Wolverhampton flats/apartments sold: 69 days

- 114 Wolverhampton terraced/town houses sold: 40 days

- 401 Wolverhampton semi-detached homes sold: 39 days

- 177 Wolverhampton detached homes sold: 65 days

By number of bedrooms in Wolverhampton:

- One-beds: (39 sold) 27 days

- Two-beds: (201 sold) 50 days

- Three-beds: (450 sold) 44 days

- Four-beds: (110 sold) 43 days

- Five-beds or more: (20 sold) 77 days

(Wolverhampton city centre plus a 3-mile radius. Sold means Sale Agreed/Sold STC).

Yet not every home sells …

Only 68.09% of the Wolverhampton homes that left estate agents' books since January 1st were sold, and the owners moved. The other 31.91% were withdrawn unsold. In other words, just under a third of the people who tried to sell in Wolverhampton never actually moved.

Why do many Wolverhampton homes not sell?

Selling a home in Wolverhampton is about far more than listing it on a property portal and waiting for the phone to ring. There are two main reasons why some homes linger on the market or never sell. They are price and marketing.

- The importance of pricing your Wolverhampton home

Getting the price right is the most significant factor in securing a successful sale. If the asking price is out of step with similar properties, buyers will ignore the listing. Many sellers are tempted to try their luck with a higher figure, but the numbers show why this is a risky move.

Research by Denton House using data from TwentyEA highlights the role of timing. If your home goes under offer (i.e. sale agreed or sold STC) in the first 25 days of coming onto the market, there is a 94% (19 out of 20) chance the sale will proceed through to completion (i.e. you move home). If it takes more than 100 days to secure a buyer (because you initially tried at a higher price and then subsequently reduced your asking price), the chance of the sale proceeding through to completion falls to just 56% (approximately 1 in 2). Put simply, time is the enemy.

When choosing a Wolverhampton estate agent, do not fall for the one who promises the highest asking price. The only thing that truly sets the value of your Wolverhampton home is what the market is willing to pay, not what an agent says and not what you hope as the homeowner. The best agent is the one with the best strategy to attract buyers and create competition, because that is how you achieve the highest price in reality.

That is why you should work with an estate agent who knows the Wolverhampton market inside out and can support you with an accurate pricing strategy. Asking more than buyers are willing to pay is a gamble that can cost you your move.

- The power of marketing your Wolverhampton home

Alongside pricing, the way your home is marketed is crucial. Buyers browsing Rightmove or On the Market make instant judgments based on the photographs. Poor-quality images or old seasonal shots can kill interest before anyone even reads the description. For example, if your home still has pictures with no leaves on the trees and daffodils in late summer, it suggests the property has been on the market for many months.

Strong marketing by an estate agency involves professional photography, updated images that reflect the changing seasons, clear floor plans, and compelling descriptions. Increasingly, buyers also expect video tours or 360-degree virtual walkthroughs, allowing them to get a feel for the property before visiting. Well-presented marketing is not a gimmick. It widens your audience and creates competition, which in turn helps you achieve the best price.

Selling your home in Wolverhampton

Wolverhampton home sellers shouldn’t be complacent. Averages conceal the reality that many homes sell quickly, while others languish. Your choice of agent, your pricing decision, and the way your property is showcased will decide which side you fall on.

Moving home is a significant decision to make. It deserves careful preparation, clear communication, and above all, a strategy that is tailored to you. We specialise in helping Wolverhampton homeowners and landlords to navigate the sales process, combining local knowledge with modern marketing.

Whether you own a detached family home in Wolverhampton, a terrace or flat near the centre, or a semi on the edge of the city, we can help you secure the right buyer and the right outcome. If you are thinking of selling, we would be delighted to talk through your plans and show you how to maximise your chances of success.

- Details

Are you considering moving home in Wolverhampton during the next 6 to 12 months?

You may be a Wolverhampton landlord deciding whether to grow your portfolio or sell off a few properties. Or you're a Wolverhampton first-time buyer wondering if now is the right time to move.

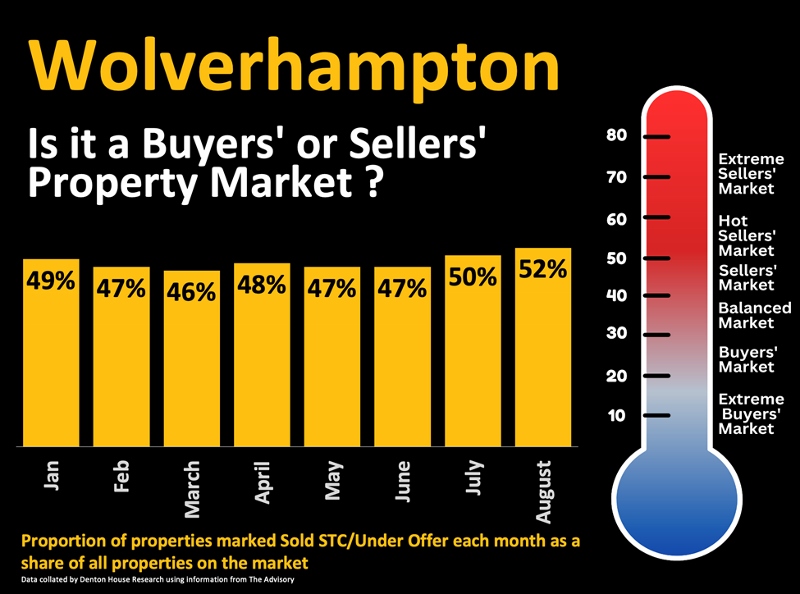

Understanding whether the current property market favours buyers or sellers is key to making the right call. If you follow our regular Wolverhampton property updates, you'll know one of the most reliable ways to assess the market is by looking at the percentage of homes marked as "Sold STC" or "Under Offer" compared to the total number of properties on the market.

Let's show that in practice. In this example, if there are 400 properties on the market in a location, and say 300 properties are for sale, fully available to buy, and the remaining 100 are under offer or sold. 100 as a percentage of 400 gives us a sales percentage of 25%. It is this percentage that strongly indicates the local property market temperature and who holds the upper hand, i.e., buyers or sellers (or somewhere between).

This percentage figure acts as a barometer for market conditions and can be analysed using this table:

- Extreme Buyers' Market (0%-20%)

- Buyers' Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers' Market (41%-49%)

- Hot Sellers' Market (50%-59%)

- Extreme Sellers' Market (60%+)

How Does Wolverhampton Compare?

Examining historical data from The Advisory's website, which has tracked this metric for years, reveals some key trends for each month in 2025. (For this exercise, Wolverhampton is WV1/2/3/4/6/10/11).

- January 2025. 49%.This placed Wolverhampton at the upper end of a sellers’ market, giving sellers a modest advantage to start the year.

- February 2025. 47%.A slight decline kept conditions within the sellers’ market, though with a little more room for buyers to negotiate.

- March 2025. 46%.A further easing maintained Wolverhampton in the sellers’ market, reflecting stability rather than major change.

- April 2025. 48%.The figure edged back up, reinforcing the sellers’ market position and showing steady demand.

- May 2025. 47%.A small dip kept the market in sellers’ territory, signalling consistency.

- June 2025. 47%.The figure remained unchanged, highlighting stability within the sellers’ market.

- July 2025. 50%.A rise moved Wolverhampton into a hot sellers’ market, giving sellers stronger leverage.

- August 2025. 52%.Another increase consolidated conditions in the hot sellers’ market, showing that demand remained resilient.

Overall trend. From January to August 2025, Wolverhampton’s figures ranged between 46% and 52%. The city has consistently been in a sellers’ market, with more recent months pushing into the hot sellers’ category. Overall, conditions have leaned firmly in favour of sellers, supported by steady buyer demand.

These percentage figures are an average of the Wolverhampton postcodes (as noted above).

For interest, if we break down the August 2025 figure by individual Wolverhampton postcodes, it actually tells an even more interesting story…

- WV1 – 55%

- WV2 – 48%

- WV3 – 51%

- WV4 – 50%

- WV6 – 43%

- WV10 – 51%

- WV11 – 65%

Look at the difference between the postcodes!

So, what does a 52% "Sold STC to total stock" ratio mean for Wolverhampton right now?

It places the local market at the lower end of a hot sellers’ market. Sellers have the advantage and buyers need to bring their best game.

For Wolverhampton Sellers

We are firmly in a market where patience, presentation, and accurate pricing matter more than ever. Buyers now have a choice, a lot of choice. Simply listing your property and hoping for the best will not cut it.

The homes that sell are those that hit the market with the right price from day one, have high-quality photography, clear floor plans, strong virtual/video tours, and marketing that stretches both online and offline.

Overpricing is the fastest way to stall a sale. Properties that linger usually face price reductions, lose momentum, and invite lower offers. In some cases, that even leads to failed sales before the exchange.

Getting it right at launch is critical.

The good news is the recent interest rate cut provides a welcome tailwind as first-time buyers are seeing lower monthly payments, encouraging more of them into the market and strengthening chains. Also, home movers can access better fixed-rate deals, helping them upsize, remortgage, and release more homes onto the market to buy. Finally, buy-to-let investors in Wolverhampton's stronger-yielding areas may see the sums stacking up again.

Buyer sentiment is shifting. Rate cuts show the Bank of England wants growth and stability, which converts hesitant "wait and see" buyers into active "let's book a viewing" buyers.

This is not a one-off. The cut follows earlier reductions since late 2024. This means mortgage rates are more palatable, with some two-year fixes, at the time of writing, being below 3.75% on a 60% loan-to-value (LTV) basis, and an impressive 3.86% on a 5-year fixed (60% LTV). For first-time buyers with a 5% deposit, a 3-year fixed 4.78% rate on a 95% LTV mortgage looks pretty fair.

For Wolverhampton Buyers

The market is calmer than the frenzy of 2021 and 2022. There is time to think, compare, and in some cases negotiate. That does not mean you can wait indefinitely or fire in lowball offers. The best homes are still competitive, but opportunities exist if you are open-minded and look beyond the most sought-after postcodes. Have your mortgage agreement in principle ready before making an offer. It sets you apart and gives sellers confidence. Also, consider widening your search area, as value is often found just beyond the obvious hotspots.

Final Thoughts on the Wolverhampton Property Market

With inflation rising slightly (meaning interest rates won’t be coming down too much in the near future) and the Government finances looking a little squeaky, while the UK’s (and Wolverhampton's) property market is enjoying a steadier footing, realistic pricing is the ultimate and most important thing in marketing a property. Remember last month, only 50.9% of homes that left estate agents' books ended up being sold and the homeowner moving (the rest being withdrawn from the market unsold). Of course, you might not get what you would've got a few years ago in the crazy years of 2020 and 2021, but the price you'll have to pay on the next one won't be as much either.

If you are considering a move within the next six months or would like to explore your options, let's talk. And even if you are not moving, I would love to hear your thoughts on where you see the Wolverhampton market heading.

- Details

A step-by-step guide for Wolverhampton homeowners

You want more space. The kitchen bleeds into homework time. The spare room became an office, then a dumping ground. The obvious answer used to be to extend.

Yet over the last few years, the sums have changed. This is an article for Wolverhampton homeowners who are weighing up an extension against moving. It gives you the maths, the practical snags, and a simple checklist so you can make a confident decision for your family.

The simple maths of extending your Wolverhampton home in 2025

Think of an extension as two numbers fighting each other.

- What it adds to value.

- Roughly, added value equals new floor area multiplied by what buyers pay per square foot in your street and your price band.

- Added value = new area × local £ per sq.ft.

- What it really costs.

- Not just the bricks and labour. Add professional fees, approvals, VAT, a sensible contingency, and the life disruption that no one prices in at the start.

- All-in cost per sq. ft = build cost per sq. ft × VAT × fees × contingency.

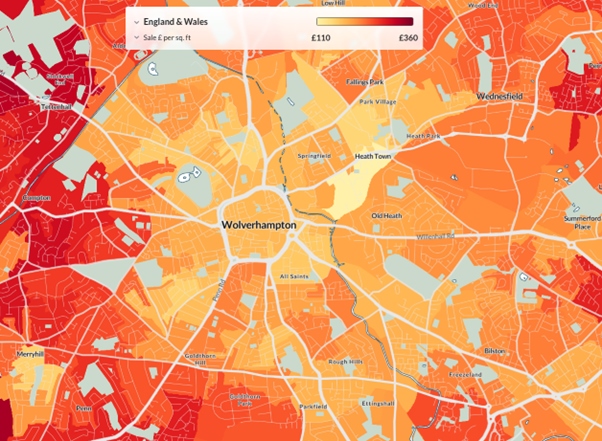

So, let's look at the average value achieved …

2,384 houses have sold in the last 12 months in Wolverhampton.

The average £ per sq. ft has been £259 per sq. ft.

(Wolverhampton WV1-4/6/10/11).

Next, we must look at the costs.

Use this as a starting point for most single-storey projects in 2025.

- Build cost per sq. ft - the budget end is around £167 per sq. ft, all the way up to £325 per sq. ft for top of the range.

- VAT is 20% on extensions, so that must be added to the above figure.

- Professional fees and approvals are on top and are between 10 to 15% of the build cost.

- Contingency (money if things go wrong), at least 10%, ideally 12.5%.

So, a mid-level Wolverhampton property, the all-in cost per sq. ft looks like this.

- Mid-level range build at £243 per sq. ft.

- With VAT, that increases to £291 per sq. ft.

- Add 15% for professional fees, now it's £334 per sq. ft.

- And finally, adding 10% for contingencies, that leaves about £367 per sq. ft, all-in.

That number matters. It is the breakeven point for your home extension.

However, two-storey projects can offer better value because foundations and roofs are shared. A rough rule that many use is that extra storey costs are about 30% to 50% cheaper per square foot for the first floor.

Let me look at some worked examples.

A single-storey 200 sq. ft worked example

- New area, 200 sq. ft.

- Cost per sq. ft £367.

- Total project outlay for a single-storey Wolverhampton dwelling = £73,400.

- Total value added (200 sq. ft at £259 per sq. ft) = £51,800.

A double-storey 400 sq. ft worked example

- New area, 400 sq. ft.

- Cost per sq.ft (the ground floor - 200 sq. ft at £367 and first floor 200 sq. ft at £256).

- Total project outlay about £124,600.

- Total value added (400 sq. ft at £259 per sq. ft) = £103,600.

You can see the gap.

Wolverhampton is not one market. The old part, the interwar semis, new build estates, village edges, each has a different £ per sq. ft, so let’s look at this map …

Yet, it is not all about the pure pound notes when deciding to extend or not. Let us expand on those ..

- Details

In the summer of 2020, Wolverhampton's property market, like the rest of the UK, roared back to life after weeks of pandemic lockdown. It was a strange moment in history. The pause in the British housing market had created a bottleneck of pent-up demand, and when the doors reopened, homes that might have taken months to sell were suddenly attracting multiple offers in a matter of days.

Average asking prices jumped sharply, fueled by a combination of limited supply, government incentives such as the temporary stamp duty cut, and a rush of buyers rethinking their living arrangements. For many, the pandemic was a nudge to make changes they had been considering for years, and others, it was the trigger for an impulsive leap.

Buyers who had been cooped up in flats suddenly had the freedom (and in many cases, the budget) to look for more space. A house with a garden, perhaps a home office, or even a semi-rural location outside the main town, became the dream. For some, it was a complete relocation from busier urban areas to the countryside.

In those frenzied months of 2020 and 2021, the competition was fierce. Both our estate agent colleagues and with other agencies in the city, recall Wolverhampton homes being listed on a Friday and sold by Monday morning, often well above the asking price. Many buyers were willing to compromise on location, condition, and amenities to secure a property.

Now, certain newspapers and commentators are saying there is a flood of homeowners putting their homes on the market for sale who bought in that initial post-pandemic rush. Before we look at what is happening in the Wolverhampton property market, let us explore why this could be happening.

Why are these homes coming back to the market?

Several factors are at play:

- Changing work patterns

In 2020, many people were told they could work from home indefinitely. That made a longer commute seem irrelevant. But since 2022, more employers have been encouraging or mandating a return to the office, even if it is just for part of the week. For some, that means facing the reality of a long drive or a costly rail season ticket again.

- Mortgage costs

Back in mid-2020, five-year fixed mortgage rates (75% loan-to-value) were just above 2%. Now they are hovering around 4% to 4.2% (even with the recent interest rate cut). For households that stretched themselves financially during the pandemic, this has created real pressure as fixed deals expired. In some cases, the only way to manage rising costs is to downsize or move to a more affordable area.

- Lifestyle reassessment

During the pandemic, the appeal of more space was overwhelming. But bigger gardens mean more upkeep. Longer distances from shops, schools, or family can be inconvenient. Some people have found that the trade-offs they accepted in 2020/1, for example, being miles from the nearest railway station or amenities, are no longer worth it.

- Second-home pressure

While not as common in Wolverhampton itself, those who bought second homes in coastal or rural spots during the pandemic are now facing higher running costs and new council tax surcharges. That has pushed some to sell, adding more properties to the broader regional market.

- Pure buyer's remorse

In the heat of the pandemic property boom, decisions were often made quickly and with limited viewing opportunities. Some owners are now simply realising that the house they bought doesn't suit them as well as they had hoped.

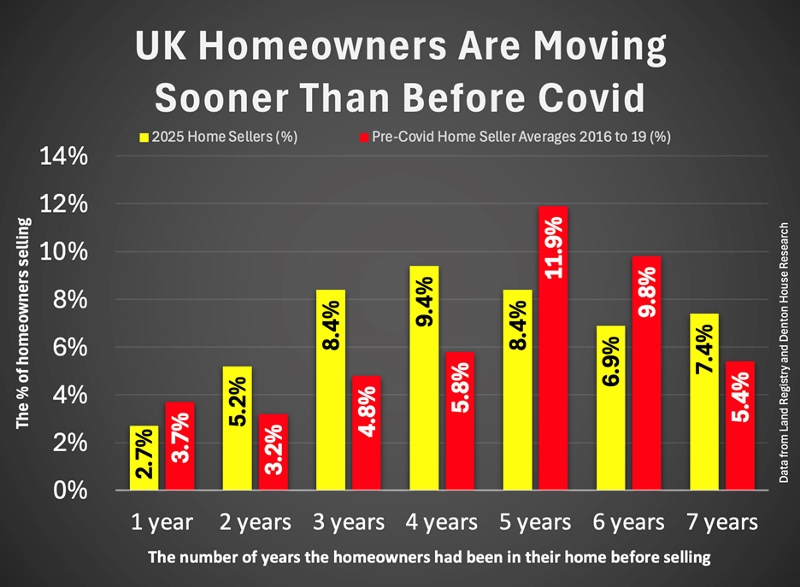

So, let us look at the cold hard facts in the British property market

In the years before Covid (2016–2020), 29.4% of homes that sold had been owned for five years or less. Over the last 12 months, that figure has risen to 34.1%. A proportional rise of 16%. So, a rise, not a flood.

If we extend the time frame to seven years or less, the difference narrows to 44.6% pre-COVID compared with 48.4% in the past year.

The real change lies in when people are moving. Pre-Covid, more sales happened in years five and six of ownership. Today, there is a clear uplift in people moving earlier, particularly in years three and four.

Wolverhampton Property Market Stats

Looking at the stats locally, let us see what is happening in Wolverhampton (WV1/2/3/4/6/10/11).

Of the 1,910 homes for sale or sold stc …

163 of those were purchased between the middle of May 2020 and the end of December 2021. Meaning 8.5% of Wolverhampton homes bought in the 18 months after lockdown are back on the market (either available or sale agreed SSTC).

They are split down:

- Detached - 41, which represents 9.1% of the detached Wolverhampton homes for sale.

- Semi - 69, which represents 9.0% of the semi-detached Wolverhampton homes for sale.

- Terraced/town house – 24, which represents 7.3% of the Wolverhampton terraced/town homes for sale.

- Bungalow - 12, which represents 8.9% of the Wolverhampton bungalows for sale.

- Flat/apartment - 17, which represents 7.3% of the Wolverhampton flats/apartments for sale.

The impact on house prices in Wolverhampton

Across the country, the total number of properties for sale is at its highest since 2013, and Wolverhampton is no exception. Compared with the height of the pandemic, stock levels locally have risen sharply. While more choice is good news for buyers, it creates a more challenging environment for Wolverhampton home sellers, especially those who overpaid in the heat of the market.

The property price growth of the pandemic years has slowed down. Between mid-2020 and September 2022, average prices in Wolverhampton rose significantly, as the rush for space played out. But in the past two and a half years, house growth has been almost flat.

Homes that are priced correctly still sell well, but the days of "name your price" are gone. Overpricing is particularly risky in a market with more competition. In the last three months, 35.7% of the 768,500 homes for sale had to reduce their prices.

Advice for Wolverhampton house sellers in 2025

If you bought during the pandemic and are now considering selling, the key is to be realistic:

- Price for today, not for 2021. Use evidence from recent completions in your area, not what your neighbour sold for three years ago.

- Presentation matters. In a more cautious market, buyers are drawn to properties that feel turnkey and well-maintained.

- Be ready to negotiate. Buyers know there is more choice and will push for value.

- Choose an agent who knows the data. The best local estate agents can show you exactly how your home compares to others in terms of days on market, percentage of asking price achieved, and past selling history.

For Wolverhampton buyers, it's an opportunity.

For those looking to buy in Wolverhampton, the current conditions are far better than they were five years ago. There's more choice, less competition, and in many cases, room to negotiate.

The "five-year itch" means there's a steady supply of relatively modernised homes from the 2020–21 buying spree coming onto the market. Many are in good condition, as owners have only been in them for a short period.

Looking ahead

It's unlikely we'll see a return to the intense post-pandemic conditions in the Wolverhampton market any time soon. The dynamic between supply and demand currently favours buyers, and while falling mortgage rates could shift the balance slightly, most analysts expect this to remain the case into 2026.

For Wolverhampton homeowners, the lesson from the last five years is that property decisions made in haste can lead to changes of heart sooner than expected. Whether you are selling or buying, the most successful moves now are based on solid research, realistic expectations, and a clear-eyed view of what matters in your next home.